By Barbara Heimlich, Editor

Sources: Mark Pazniokas, CT Mirror; http://FindEnergy.com

Gov. Ned Lamont said a special session sought by Republicans on electric rate relief prior to Election Day would be unlikely to produce immediate or significant changes in electric rates that typically are among the highest in the U.S.

“There’s no easy, pat answers where a 12-hour special session will solve these problems,” Lamont said, prior to welcoming the Democratic co-chairs and ranking Republicans of the legislature’s Energy and Technology Committee into his office for a closed-door meeting.

“We all agreed that the fundamental problem we have right here is supply and demand in the state of Connecticut,” Lamont told reporters after the meeting. “How can we reduce our demand through efficiency, and more importantly, how do we get additional power generation here in the state of Connecticut?”

The ranking GOP members, joined by Senate Minority Leader Stephen Harding, R-Brookfield, continued to publicly press for a pre-election special session to consider, among other things, using unallocated ARPA money, the federal aid provided by the American Rescue Plan Act. “I have a hard time believing that you could find better priorities than to use it towards paying down some of these rates for the hardworking people of this state,” Harding said.

Lamont agreed to an analysis of how much ARPA money might be available with an eye towards applying it to offset some of the $200 million owed to the electric utilities, Eversource and United Illuminating, to compensate them for customer arrearages that blossomed during a long state-ordered moratorium on shutting off power over unpaid bills.

“I don’t want to do something token. I want to do something that’s real. And I think we ended up saying, ‘Let’s do an analysis of what, if any, ARPA money there may be left over we can use to help pay down some of the moratorium shortfall,’ ” Lamont said. “That would help a little bit. We ought to have a better handle on that in about the next 10 days.” The Lamont administration says the number, which must be assessed after an agency-by-agency review, most likely is tens of millions, not hundreds.

Under current law, the governor is obligated to use the first $40 million of unallocated ARPA funds to cover budget shortfalls in higher education.

The arrearages amassed during a moratorium imposed in the early days of the COVID pandemic are a relatively small portion of what drove the recent rate increases. A bigger factor are the favorable rates paid for the electricity generated by the Millstone nuclear power plant.

Only the distribution of electricity in Connecticut is regulated by the Public Utilities Regulatory Authority. The cost of generating power is set in competitive markets.

Under a law passed in 2017 to stabilize the finances of Millstone, the plant was allowed to sell its power in a more favorable market through fixed power purchase agreements, like those typically used by to buy solar, wind and hydro power.

Millstone had been selling its power in a competitive market where the prices were depressed by cheap natural gas. The low prices contributed to the closure of nuclear plants in New York, Vermont and Massachusetts, and Connecticut lawmakers feared Millstone might follow suit.

The Millstone law was passed prior to Lamont’s election, but he supports the policy as a means to preserve the state’s largest source of carbon-free power.

“If we did not have Millstone, if we did not have nuclear power in this state and in this region, our electricity prices would be much, much higher than they are today. Thank God we have that additional capacity. I wish we could expand on that capacity,” Lamont said.

When the price of natural gas, a fuel used to generate electricity in New England, rose sharply a few years ago, the Millstone deal saved ratepayers money. More recently, the marketplace fell below the fixed nuclear price, increasing costs on the utilities that ultimately are recoverable from ratepayers.

Compensating the utilities for the arrearages and Millstone expenses are part of the “public benefits” portion of electric bills. Others are the cost of building out electric vehicle charging stations and offering energy audits that result in efficiencies and lower demand.

Sen. Ryan Fazio of Greenwich, the ranking Senate Republican on the energy committee, said many of those public benefit expenses should be part of the state budget and examined annually. Currently, he said, those costs are buried in electric bills as “a hidden tax.” Fazio said he counted 41 separate programs funded by the public benefits portion of electric bills. “Many of those programs should still exist. Some of them should be pared back. But many shouldn’t exist at all going forward,” Fazio said.

A big piece of Connecticut’s complicated electricity puzzle started to fall into place this week with the completion of the first of 65 wind turbines for the Revolution Wind project off Rhode Island’s shore.

Officials from Ørsted and partner Eversource, along with numerous state and federal officials from both states, celebrated the milestone. Revolution Wind, which at maximum output is expected to produce 704 megawatts of electricity to power over 350,000 homes across Connecticut and Rhode Island, is the first utility-scale offshore wind farm for the two states. It’s also the first multi-state offshore wind farm in the nation.

Aside from creating about 1,200 jobs and moving both states toward their shared goals of producing electricity from renewable, carbon-free sources, the project is also going to help Connecticut keep pace with its residents’ ever-increasing demand for electricity.

Connecticut Gov. Ned Lamont said Revolution Wind will have a major impact in the Northeast. He has described the state’s high electricity prices as a supply and demand problem.

“The completion of this first turbine represents a milestone as we work toward decarbonizing our electric grid while also creating new, good-paying jobs in this growing sector for Connecticut residents,” Lamont said.

David Hardy, Group EVP and CEO of Americas at Ørsted, also touted the jobs created by the project.

“Seeing the first turbine rise above the water at Revolution Wind is another unforgettable moment for this new American energy industry we’re building together,” Hardy said. “Revolution Wind is bringing local union jobs and economic development to Rhode Island and Connecticut, and it will deliver clean offshore wind power to hundreds of thousands of homes in the region.”

Joe Nolan, Eversource’s Chairman, President, and CEO, said the completion of the first turbine was made possible by hundreds of workers.

“Today we celebrate a major offshore wind milestone with the installation of the first turbine for Revolution Wind, and it is a milestone made possible by the hundreds of hardworking tradesmen and women at our region’s ports,” Nolan said. We look forward to continuing our progress and, for the first time, bringing commercial-scale, 100% renewable offshore wind energy to Rhode Island and Connecticut.”

Quantifying Revolution Wind’s Impact

Connecticut’s share of Revolution Wind’s output is 304 of its 704 total megawatt capacity. Measured in megawatt hours (MWh) over the course of an entire year, 304 MW would come to 2,663,040 MWh if the turbines were to receive a continuous amount of wind for all 8,760 hours in a given year.

However, wind is not consistent and various industry publications say modern wind turbines produce electricity 70% to 85% of the time, and at variable outputs based on wind speed. Over the course of a year, the industry estimates that offshore wind turbines generate about 41% of their maximum output. The industry defines this as its “capacity factor.”

According to FindEnergy.com, over the last 12 months Connecticut used 26,896,680 MWh of electricity. Once it begins operating with all 65 turbines for a full year, Revolution Wind is likely going to produce around 1,091,846 MWh for Connecticut annually, or between 4% and 5% of the state’s current electricity usage.

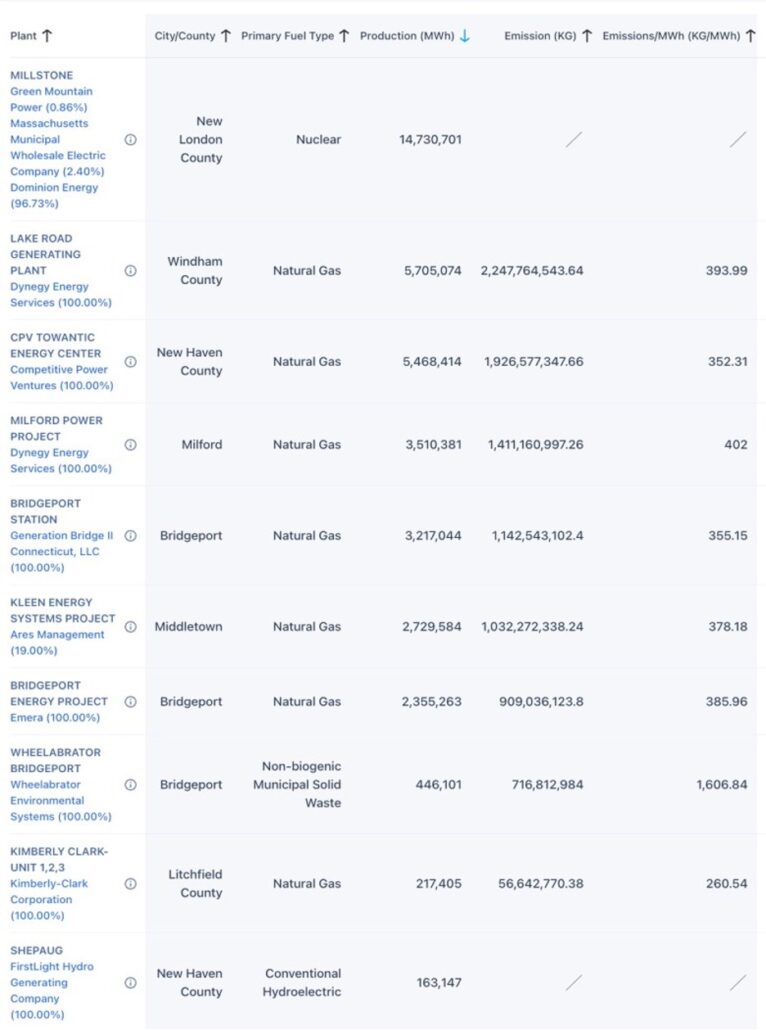

At 1,091,846 MWh, Revolution Wind would be the eighth largest producer of electricity in Connecticut’s portfolio.

FindEnergy.com lists 122 total power plants in Connecticut, though most of them are small and not working at utility scale. The list is topped by the Millstone nuclear plant in Waterford, which produces 14.73 million MWh annually, and dwindles down to small generation companies that produce less than 100 MWh per year.

How Much Will It Cost?

In 2019, the state agreed to purchase 200 MW per year for 20 years from Revolution Wind at $99.50/MWh, and then another 104 MW at $98.43/MWh.

Those prices per MWh convert to 9.95 cents and 9.843 cents per kilowatt hour for consumers – which averages to 9.914 cents per kilowatt hour. However, since Revolution Wind is only expected to provide about 4% to 5% of the state’s electricity, only 4% to 5% of the supply portion of ratepayers’ bills would be priced at 9.914 cents/kwh.

Rhode Island will see a larger benefit from the project.

As a smaller state, Rhode Island only used 7,405,634 MWh over the last 12 months. Using the same arithmetic and the same capacity factor, Revolution Wind is likely going to provide 19% to 20% of the state’s electricity when it is complete.

Revolution Wind is using 11-megawatt turbines manufactured by Spain-based Siemens Gamesa – the same model used at the recently completed South Fork Wind project that is supplying electricity to Long Island.

The top 10 electricity plants in Connecticut as of Sept. 4, 2024