Time to Sell – or – Time to Buy?

By Osi Rosenberg,

A to Z Realty,

LLC [email protected]/www.atozct.com

It is the middle of the pandemic and lockdowns are looming. Here is how things look in Stratford! At the time this was written, November 18, 2020, there are 83 properties on the market with a price range of $45,000 to $2.3M. An impressive range for our humble little town. While we don’t have a lot of inventory, the real question is, what kind of market are we in? Buyer or Sellers? Good question! It is hard to say how this will play out with so many moving parts such as the pandemic response in CT and surrounding states, the elections finalization, and the much awaited, highly anticipated vaccine.

Key Conditions:

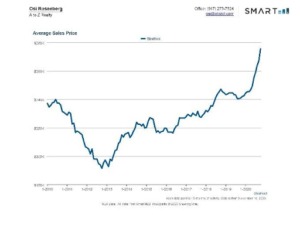

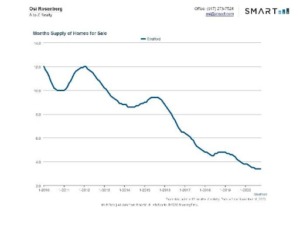

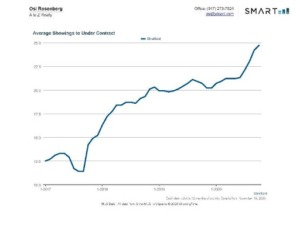

Let us go back to economics class for a moment. What happens when there is very little inventory (sellers), and a lot of demand (buyers)? If your Virtually Educated Middle Schooler answered prices skyrocket, they would be correct! When we have very few homes on the market and buyers pouring into the state, there is a huge demand that causes buyers to fight tooth and nail to outbid their competition. In some cases, having the winning bid meant bidding on homes $20,000 to $50,000 over asking price in parts of the state. This makes a Sellers’ market that Stratfordites and all of CT seemed to enjoy over the summer months. Summer is usually a busy time in real estate, 2020 did not change that, in fact it was impressive on all accounts. Buyers from NYC flocked to the suburbs to stretch their legs in the new remote work environment. I’ve even heard it described as the “Great Exodus”!

Market Drivers:

Now, the initial wave of panic has settled, and the pouring out of NY has slowed. What happens when the supply is increased and the demand decreases? You guessed it, the exact opposite, the infamous Buyers’ market. Where Buyers underbid and Sellers have two choices; wait for the market to turn, or accept lower than asking price. With the winter months approaching, colder weather, darker days and COVID-19 still looming, a Buyers’ market certainly seems very possible.

Now, the initial wave of panic has settled, and the pouring out of NY has slowed. What happens when the supply is increased and the demand decreases? You guessed it, the exact opposite, the infamous Buyers’ market. Where Buyers underbid and Sellers have two choices; wait for the market to turn, or accept lower than asking price. With the winter months approaching, colder weather, darker days and COVID-19 still looming, a Buyers’ market certainly seems very possible.

Opportunities Amidst Challenges:

So where are we here in Stratford? Like the rest of CT, Stratford had its fair share of the benefits of the Great Exodus. I would attribute this to the position on the Metro North and Forest to Shore small town feel. During the pandemic, Stratfordites, supported each other through its religious and civic organizations as well as its municipal initiatives. Stratford has so much to offer and just a hop, skip, and train ride to the city. But as they say, what goes up, must come down. Homes are not flying off the market like they were, Sellers are seeing higher numbers of showings to contract, and Buyers are being braver with their low ball offers. The good news is that buyers are still looking, and homes are still going on the market, but like the ebb and flow of the tide, there is a familiar feeling in the current of Stratford Real Estate Market. What will happen going into the holiday season and beyond? Time will tell, but Buyers’ Market warnings are around us.

Fair Market values always drop a little in the winter months and it will be interesting to see how the market fairs the next few months. I’ll be watching.

Sneak Peek at the next edition:

Short Sales and REO’s are Reading their Ugly Heads Again.

Now that courts are back in session, the pause on evictions, stalled foreclosures, and extended law days are coming to an end, February and March will likely see a huge uptick in foreclosure proceedings. Next edition, I will discuss the issues involved in Distressed Homes, Short Sales and how they affect the market. If you want to discuss your distressed property sooner than later, contact A to Z Realty, LLC 203.738.5999. We are always available to assist.

Real Estate Question Corner:

I was asked the other day about refinancing opportunities and if it is worthwhile in this market.

Considerations:

Here are the factors to consider:

- What is your current mortgage rate?

- What is your current Loan to Value ratio?

- What is your current mortgage payment versus what you may pay with a new loan?

- Do you have enough equity to do a no-money-down refinance?

- Are you interested in cash out refinance?

- How’s that credit score?

Your best first step is to contact a Mortgage Professional and discuss your options. There are several mortgage professional businesses based right here in Stratford.

*Note that the figures in this article are taken from InfoSparks statistics with the restriction of Stratford, CT/All Price Ranges/All Property Types/All Bedrooms/All Bathrooms/All Sizes.